Apple is one of the most well-known and successful companies in the world, and its stock price is closely watched by investors and traders alike. In this article, we will take a closer look at the Apple stock price on eToro, a popular online trading platform, and analyze its trends and make predictions for the future.

Understanding the Stock Market

Before we dive into the specifics of the Apple stock price, it’s important to have a basic understanding of the stock market. The stock market is where investors can buy and sell shares of publicly traded companies. The price of a stock is determined by the supply and demand for that particular stock. If there is high demand for a stock, its price will increase, and if there is low demand, its price will decrease.

Keeping Up with Stock Market News

To make informed decisions about buying and selling stocks, it’s important to stay up-to-date with stock market news. This includes keeping an eye on the overall market trends, as well as news specific to the companies you are interested in investing in. This information can help you make more informed decisions about when to buy and sell stocks.

Apple Stock Price on eToro

eToro is a popular online trading platform that allows users to buy and sell stocks, as well as other financial instruments like cryptocurrencies and commodities. It is known for its user-friendly interface and social trading features, which allow users to see and copy the trades of other successful traders.

Historical Trends of Apple Stock Price on eToro

Looking at the historical trends of the Apple stock price on eToro, we can see that it has been on a steady upward trend since its initial public offering (IPO) in 1980. However, there have been some significant dips and spikes along the way.

One notable dip occurred in 2008 during the global financial crisis when the stock price dropped from around $200 to $80. However, it quickly recovered and reached an all-time high of over $230 in 2018.

Recent Performance of Apple Stock Price on eToro

In 2020, the Apple stock price on eToro continued its upward trend, reaching an all-time high of over $500 in September. This can be attributed to the company’s strong financial performance, as well as the release of new products like the iPhone 12 and Apple Watch Series 6.

Factors Affecting Apple Stock Price

There are several factors that can affect the price of Apple stock on eToro. These include:

- Company Performance: The financial performance of Apple, including its revenue and earnings, can have a significant impact on its stock price. If the company is performing well, investors will be more likely to buy the stock, driving up its price.

- Product Releases: As a technology company, Apple’s stock price can also be affected by the release of new products. If a new product is well-received by consumers, it can lead to an increase in stock price.

- Market Trends: The overall trends of the stock market can also have an impact on the price of Apple stock. If the market is performing well, it can have a positive effect on the stock price, and vice versa.

Predictions for the Future of Apple Stock Price on eToro

While it’s impossible to predict the future with certainty, some factors can give us an idea of where the Apple stock price on eToro may be headed.

Continued Growth

Apple has a strong track record of growth, and this is likely to continue in the future. The company is constantly innovating and releasing new products, which can drive up its stock price. Additionally, with the rise of remote work and online shopping, the demand for Apple products is likely to increase, leading to further growth.

Potential Challenges

While Apple has been successful in the past, there are some potential challenges that could affect its stock price in the future. These include:

- Competition: As a technology company, Apple faces stiff competition from other companies in the industry. If a competitor releases a product that is more popular or innovative than Apple’s, it could have a negative impact on the stock price.

- Economic Downturn: In times of economic downturn, consumers may be less likely to spend money on luxury items like Apple products. This could lead to a decrease in demand for the company’s products and a decrease in stock price.

How to Invest in Apple Stock on eToro

If you’re interested in investing in Apple stock on eToro, here’s how you can get started:

- Sign up for an eToro account: The first step is to sign up for an eToro account. This can be done easily on their website or through their mobile app.

- Fund your account: Once you have an account, you’ll need to fund it with money to invest. eToro accepts various payment methods, including credit/debit cards, bank transfers, and e-wallets.

- Search for Apple stock: On the eToro platform, you can search for Apple stock by typing “Apple” into the search bar. This will bring up the stock’s profile page.

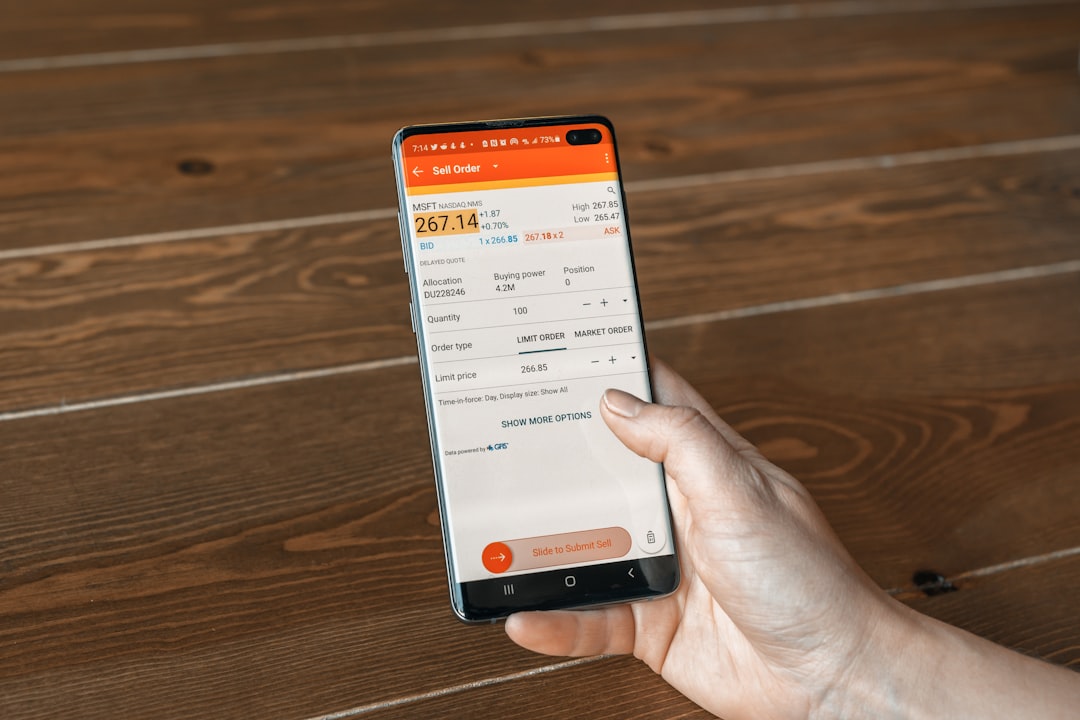

- Place an order: On the stock’s profile page, you can see its current price and performance. You can then choose to buy or sell the stock, depending on your investment strategy.

Conclusion

In conclusion, the Apple stock price on eToro has been on a steady upward trend, with some notable dips and spikes along the way. Factors like company performance, product releases, and market trends can affect the stock price, and it’s important to stay informed about these factors when making investment decisions. While there are some potential challenges that could affect the stock price in the future, Apple’s strong track record of growth makes it an attractive investment opportunity.

You may like reading about the following:

For more information, visit: Apzo Media