Costco Wholesale Corporation, commonly known as Costco, is a multinational corporation that operates a chain of membership-only warehouse clubs. With over 800 locations worldwide, Costco is one of the largest retailers in the world. In this article, we will take a closer look at Costco’s stock performance and the factors that influence it.

Understanding Costco Stock

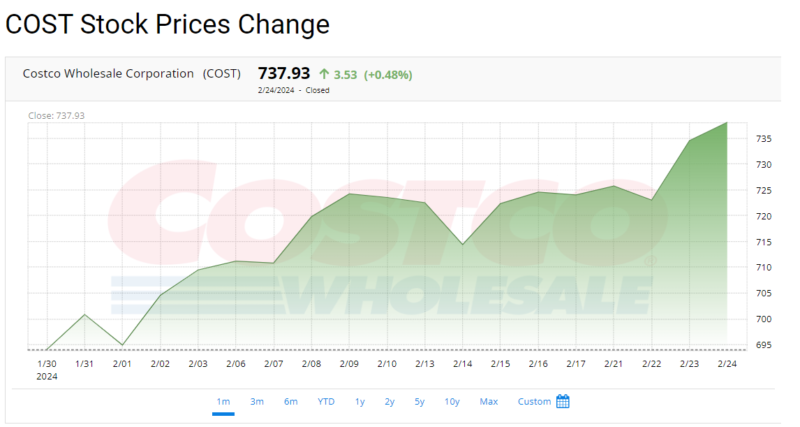

Costco’s stock is listed on the NASDAQ under the ticker symbol COST. As of September 2021, the stock is trading at around $450 per share, with a market capitalization of over $200 billion. Costco has consistently shown strong financial performance, with its stock price increasing by over 500% in the past decade.

Retail Trends and Costco’s Performance

The retail industry has been significantly impacted by the COVID-19 pandemic, with many brick-and-mortar stores struggling to stay afloat. However, Costco has managed to thrive during this time, with its stock price reaching all-time highs.

One of the main reasons for Costco’s success is its business model. As a membership-only warehouse club, Costco offers its customers bulk products at discounted prices. This model has proven to be successful, especially during times of economic uncertainty, as consumers look for ways to save money.

Additionally, Costco has also been able to adapt to changing consumer behavior by expanding its e-commerce offerings. This has allowed the company to continue serving its customers even during lockdowns and restrictions.

Stock Market Performance

Costco’s stock has consistently outperformed the broader stock market, with its price increasing by over 30% in the past year alone. This is in contrast to the S&P 500, which has only seen a 20% increase in the same time period.

One of the main reasons for this outperformance is Costco’s strong financials. The company has consistently shown strong revenue growth, with its net sales increasing by over 20% in the past year. Additionally, Costco has also been able to maintain a healthy profit margin, which has contributed to its stock’s strong performance.

Factors That Influence Costco Stock

Several factors can influence Costco’s stock performance, including:

Economic Conditions

As a retailer, Costco is heavily influenced by economic conditions. During times of economic downturn, consumers tend to cut back on discretionary spending, which can impact Costco’s sales and stock price. On the other hand, during times of economic growth, consumers have more disposable income, which can lead to increased sales and a higher stock price for Costco.

Competition

Costco faces competition from other retailers, both in-store and online. As such, any changes in the competitive landscape can impact Costco’s stock performance. For example, if a new competitor enters the market and offers similar products at lower prices, it could lead to a decrease in Costco’s sales and stock price.

Consumer Behavior

Consumer behavior, especially in the retail industry, can have a significant impact on Costco’s stock performance. Changes in consumer preferences, such as a shift towards online shopping, can impact Costco’s sales and profitability. Additionally, any negative publicity or consumer sentiment towards the company can also affect its stock price.

Fintechzoom Costco Stock Analysis

Fintechzoom, a leading financial news and analysis website, provides regular updates and analysis on Costco’s stock performance. According to Fintechzoom, Costco’s stock is currently rated as a “buy” by analysts, with a target price of $500 per share.

Fintechzoom also highlights Costco’s strong financials and its ability to adapt to changing consumer behavior as key factors contributing to its positive outlook. Additionally, the website also provides regular updates on any news or events that may impact Costco’s stock performance.

How to Invest in Costco Stock

If you’re interested in investing in Costco’s stock, there are a few options available to you:

Direct Stock Purchase

The most straightforward way to invest in Costco’s stock is to purchase it directly through a brokerage account. This allows you to buy and sell shares at your convenience and gives you full control over your investment.

Mutual Funds or ETFs

Another option is to invest in mutual funds or exchange-traded funds (ETFs) that hold Costco’s stock. This allows you to invest in a diversified portfolio of stocks, reducing your risk and potentially providing higher returns.

Costco Stock Options

For more experienced investors, options trading can be a way to invest in Costco’s stock. Options give you the right, but not the obligation, to buy or sell a stock at a predetermined price within a specific time frame. This can be a more complex and risky investment strategy, so it’s important to do thorough research and consult with a financial advisor before engaging in options trading.

Conclusion

In conclusion, Costco’s stock has shown strong performance in recent years, driven by its successful business model and ability to adapt to changing consumer behavior. Economic conditions, competition, and consumer behavior are all factors that can influence Costco’s stock performance. For those interested in investing in Costco’s stock, there are various options available, including direct stock purchase, mutual funds or ETFs, and options trading. As always, it’s essential to do thorough research and consult with a financial advisor before making any investment decisions.

For more information, visit Techmelife.com