These days small businesses/Startups has gained lot of popularity, Individuals are much interested in becoming entrepreneurs by opening their own business.

An startup is a company whose goal is to expand rapidly and grow consistently. There are 6 different types of startups.

- Lifestyle Startups

- Small business Startups

- Scalable Startups

- Buyable Startups

- Large Company Startups

- Social Startups

We have seen major growth in export-import of goods/services in India by seeing this more and more startups are venturing into this.

Getting Started for Import-Export business:-

There is the following way to start the import-export business in India.

- Set up

- Obtain a Pan card for the business

- Open a Current Account

- Get the Import-Export Code

- Obtaining the Registration cum Membership Certificate (RCMC)

- Opportunities available with exporters

- Government Incentives available to the exporters

Government is giving economic assistance by giving Incentives to the exporters to help them secure foreign markets and to make Indian Products Competitive in global markets. So it is very important for young entrepreneurs aspiring to start export business need to know about the Export Incentives in India.

In this post we are mainly going to discuss about what is the Government Incentive Scheme available to the exporters & how they can avail it India.

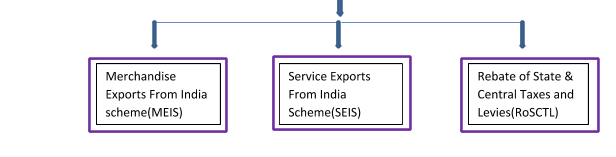

Under Government Incentive Schemes exporters can avail the benefits of 2%/3%/4%/5%/7% on the FOB value of the eligible exports, There are the following Schemes available to Indian exporters:-

Export Incentive Schemes

Merchandise Exports From India Scheme (MEIS):-

Merchandise Exports From India Scheme (MEIS):-

- MEIS Scheme is the Government Incentive Scheme under which goods exporters can avail the benefits of 2%/3%/4%/5% on the FOB value of exports in the form of Duty credit Scrip which can be transferable in nature or it can be used in the waiver of import duty payment.

- The objective of the MEIS scheme is to offset infrastructural inefficiencies and associated costs involved in the export process.

- To claim benefits under this scheme Applicant has to do online application on DGFT site – www.dgft.gov.in

- License Registration is mandatory under this scheme and the license is valid for 24 months from date of issue.

Service Export From India Scheme (SEIS):-

- SEIS Scheme is also the Government incentive scheme under which service exporters of notified services can avail the benefits of 5% – 7% on the net foreign exchange earnings.

- The Objectives of SEIS Schemes are – to promote exports of notified services & to make services more competitive in the global markets.

- SEIS scheme replaced Served From India Scheme which was present in earlier FTP for the service exporters.

- Same like MEIS scheme the application under SEIS Scheme shall be done on dgft site and custom verification of the license is must for using it at the port.

The Rebate of State & Central Taxes and Levies (RoSCTL) Scheme:

- Exporters of readymade garments and Made – ups can avail the benefits under RoSCTL scheme in the form of transferable or sellable Duty Credit Scrips depending on the FOB value of exports in the Foreign exchange from 07/03/2019 to 31/03/2020.

- The application has to be done on DGFT site. License obtained under SEIS scheme shall be valid for 24 months for utilisation at the customs.